Paying attention to every little detail

GRH payroll is quite thorough and comprehensive. The most comprehensive payroll software on the market today has been made with no expense spared. Nothing is overlooked. No circumstance was omitted.

After serving tens of thousands of clients, we can certainly assert that GRH has you covered for anything related to payroll. inputs through payments, claims through compliance checks, and self-service through settlements. GRH gives you complete control over the payroll process rather than just individual steps.

Payroll processing

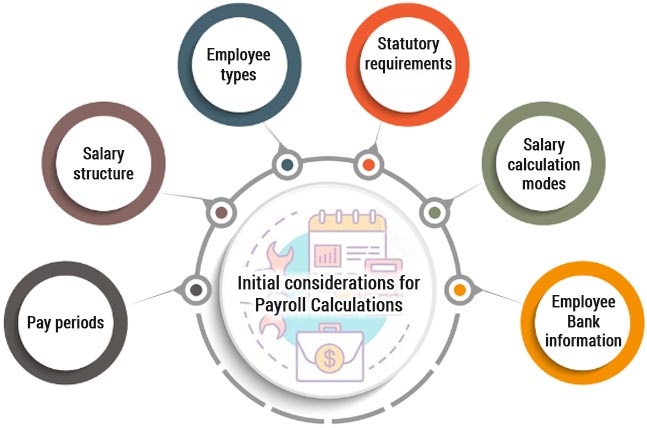

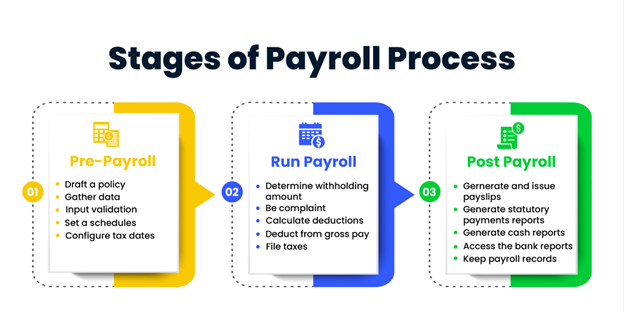

Payroll processing can be complex, especially for larger organizations with numerous employees and various compensation structures. Many businesses opt to use payroll software or outsource their payroll functions to third-party providers to ensure accuracy, efficiency, and compliance. This allows organizations to focus on their core operations while leaving the intricacies of payroll processing to experts.

Payroll compliance

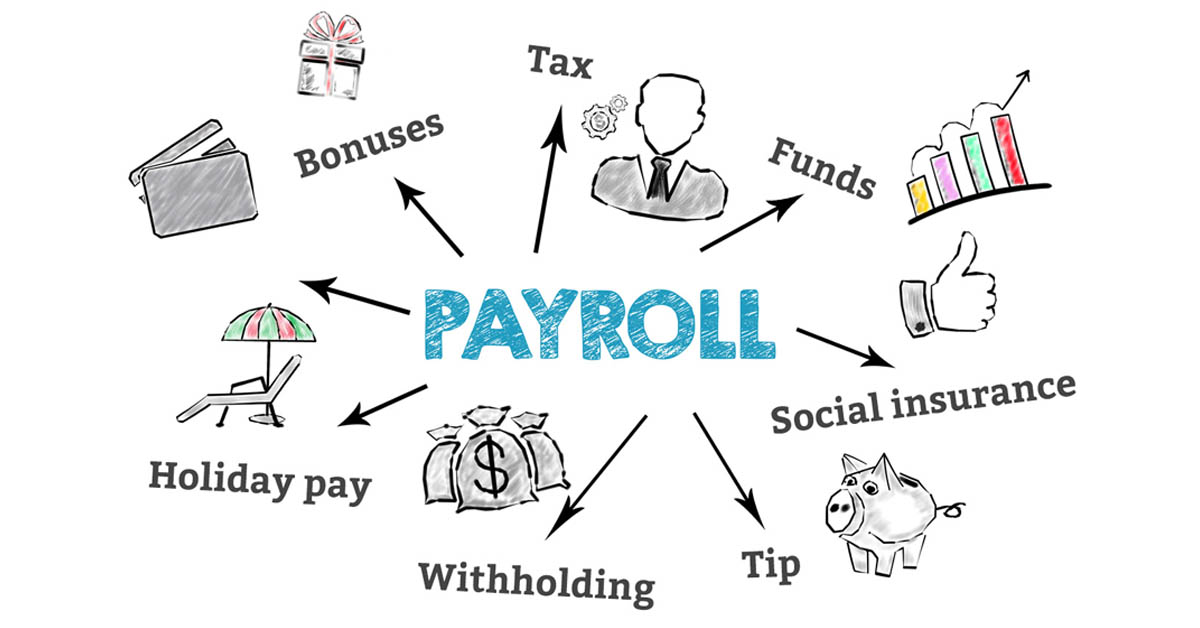

Payroll compliance refers to the practice of ensuring that an organization's payroll processes adhere to all relevant laws, regulations, and standards. Compliance in payroll is crucial to avoid legal issues, penalties, and reputational damage. It involves following rules related to employee compensation, tax withholding, benefits, reporting, and record-keeping. Here are some key areas of payroll compliance:

- Tax Withholding and Reporting

- Minimum Wage and Overtime

- Benefits and Deductions

- Record-Keeping

- Reporting Obligations

- Local and State Regulations

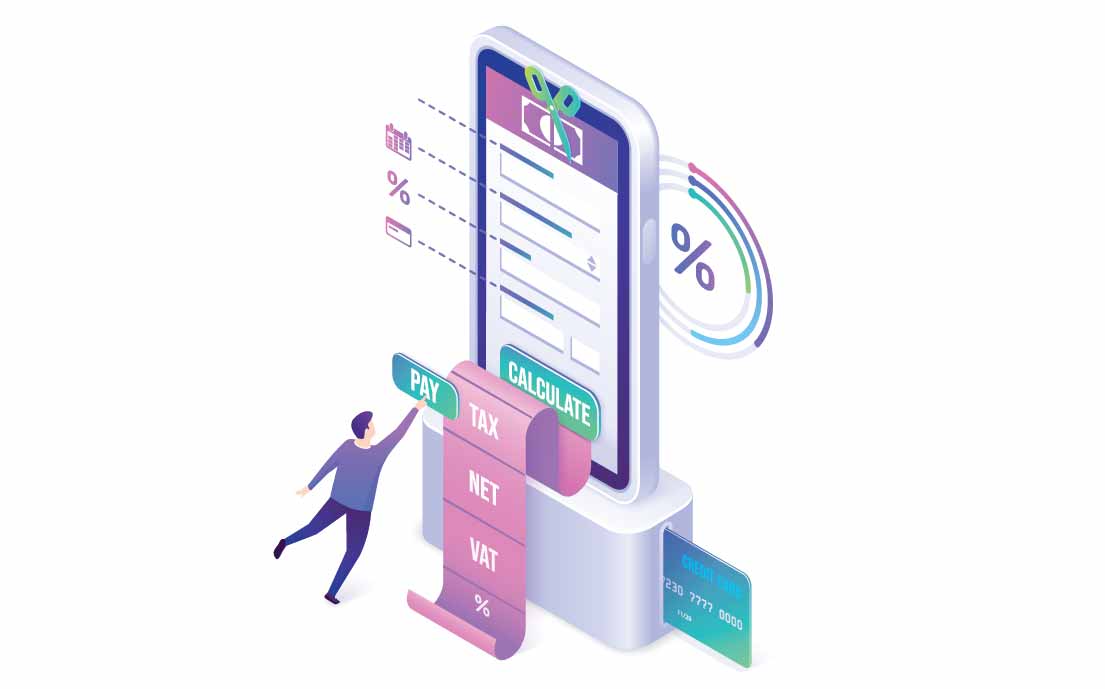

Automated Calculations

Automated calculations refer to the process of using technology, such as software or algorithms, to perform mathematical calculations automatically without manual intervention. In the context of payroll and finance, automated calculations play a significant role in improving accuracy, efficiency, and reducing the risk of errors. Here's how automated calculations are applied in various areas:

Employee Self-Service

Employee self-service (ESS) in the context of payroll refers to a system or portal that allows employees to access and manage their own payroll-related information and tasks without involving HR personnel. It empowers employees to take control of certain aspects of their payroll and employment data, resulting in increased efficiency, transparency, and convenience. Here's how employee self-service functions within payroll:

Mobile Access

Mobile access in payroll refers to the capability for employees and employers to access and manage payroll-related information and tasks through mobile devices, such as smartphones and tablets. This functionality allows users to handle various payroll-related activities on-the-go, offering convenience, flexibility, and real-time access to important data. Here's how mobile access enhances payroll processes: